Portraits in Oversight:

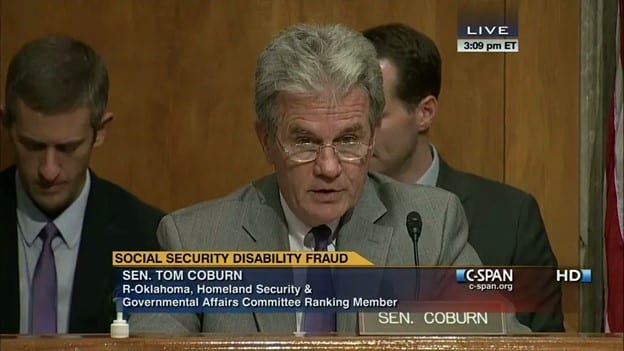

Senator Tom Coburn

Dr. Tom Coburn was an Oklahoma family physician and obstetrician who served the Sooner State in the House of Representatives from 1995 to 2001 and the Senate from 2005 to 2015. Earning the nickname “Dr. No” for introducing at least 1,000 amendments opposing government spending, he also published more than 50 oversight reports during his decade in the Senate. In addition to his “Wastebook” published annually from at least 2008 to 2014 detailing examples of what he considered wasteful government spending, Senator Coburn also investigated fraud and poor quality administrative judge decisions in Social Security disability programs; intelligence failures at state and local fusion centers; the Department of Homeland Security’s failure to secure chemical facilities from terrorist attack, misconduct at VA facilities, and more.

Although he was a prominent conservative Republican, it was well-known that Senator Coburn worked with senators on the other side of the aisle to advance issues of government oversight and excessive spending. For example, he formed a close friendship with then Senator Barack Obama (D-IL) during their 2005 Senate orientation and teamed up with him to enact the 2006 Federal Funding Accountability and Transparency Act. That Act created USASpending.gov, an online database which gives Congress and the public access to key information on government contracts and grants. Senator Obama later said of Senator Coburn, “even though we haven’t always agreed politically, we’ve found ways to work together – to make government more transparent, cut down on earmarks, and fight to reduce wasteful spending and make our tax system fairer.”

When he became senior Republican on the Permanent Subcommittee on Investigations (PSI) in 2008, Senator Coburn also worked closely with PSI Chair Carl Levin (D-MI) on a variety of high-profile investigations. The most famous is their two-year investigation into key causes of the 2008 financial crisis. Senators Coburn and Levin and their staffs proceeded on a bipartisan basis, which included joint document requests, witness interviews, hearings, reports, and press conferences.

“Tom Coburn was a terrific oversight partner in the Senate – tough, fearless, and more interested in facts than politics.”

Senator Carl Levin

The investigation uncovered staggering conflicts of interest and regulatory failures on all levels. After collecting 50 million pages of documents and conducting 150 interviews, the subcommittee held four public hearings in April 2010. At those hearings:

- Washington Mutual bank executives were confronted with evidence of the bank’s poor-quality loans, widespread loan fraud, high loan default rates, failure to verify borrower incomes, and loan officers luring borrowers into high-risk mortgages, all of which produced billions of dollars in toxic mortgage loans that helped to poison the U.S. mortgage market.

- Office of Thrift Supervision (OTS) regulators were questioned about their failure to act against Washington Mutual for its substandard mortgage practices despite OTS examiners identifying more than 500 deficiencies and for the agency’s interference with the FDIC when it tried to step in and shake up the bank.

- Credit rating agencies Moody’s and Standard and Poor’s were asked about evidence showing that their executives pressured analysts to inflate credit ratings for high-risk mortgage securities and delay downgrading those ratings when the securities began to default, thereby misleading investors about the safety of mortgage-related investments, all in an effort to grab market share and profits from the banks hiring the firms to rate their securities.

- Goldman Sachs executives were grilled about packaging poor quality loans into high-risk collateral debt obligations (CDOs), securing billions of dollars in profits by betting that mortgage securities would fall in value, and duping clients by advising them to buy shares in Goldman CDOs while Goldman secretly bet against those same CDOs and reaped huge profits at the direct expense of its clients.

The explosive hearings convinced the Senate to end the filibuster of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Signed into law three months later, the act led to the most significant U.S. financial reforms in a generation including:

- The “Volcker Rule” which prohibited banks, with narrow exceptions, from trading for their own profit rather than on behalf of their clients;

- A new conflict of interest prohibition on banks betting against their clients;

- New restrictions on issuing high-risk mortgages;

- A new requirement that banks confirm a borrower’s ability to repay a mortgage;

- Abolishment of the OTS federal agency;

- Establishment of an SEC office to police credit rating agencies;

- Formation of the Financial Stability Oversight Council, bringing federal financial regulators together to detect and curb risks in the financial system; and

- Creation of the Consumer Financial Protection Bureau to safeguard American families against predatory lenders.

The next year, PSI issued a 750-page Levin-Coburn Report, “Wall Street and the Financial Crisis: Anatomy of a Financial Collapse,” the only bipartisan analysis of the financial investigation. The report detailed what the PSI staff had learned during its investigation. At the press conference on the day of the report’s release, April 13, 2011, Senator Coburn stated, “The free market has helped make America great, but it only functions when people deal with each other honestly and transparently. At the heart of the financial crisis were unresolved, and often undisclosed, conflicts of interest. Blame for this mess lies everywhere from federal regulators who cast a blind eye, Wall Street bankers who let greed run wild, and members of Congress who failed to provide oversight.”

Another important investigation by Senator Coburn, which he led while ranking Republican on PSI and then on the full Committee on Homeland Security and Governmental Affairs, exposed fraudulent practices in Social Security disability programs. The inquiry focused on a Kentucky attorney, Eric Conn, who represented clients whose disability claims had been rejected by the Social Security Administration (SSA). The Conn law firm was, despite its small size, one of the largest recipients of SSA attorney fees, pulling in millions of dollars for representing claimants appealing benefit denials.

After collecting extensive evidence, Senator Coburn issued a report and held a hearing disclosing:

- Actions taken by the Conn law firm to hire doctors with suspended or revoked medical licenses to perform cursory medical exams and sign pre-filled disability benefit forms containing false information;

- Inappropriate collusion between Eric Conn and Social Security Administrative Law Judge David B. Daugherty to assign cases to the judge and obtain quick favorable decisions;

- Records from the judge’s bank account containing multiple unexplained cash deposits;

- The award of substantial disability benefits to claimants represented by Eric Conn despite earlier benefit denials;

- The destruction of documents and computer hard drives by the Conn law firm during the investigation; and

- Inept or inappropriate oversight by Social Security management that allowed the misconduct to continue for years.

In subsequent criminal cases, Eric Conn and the judge pleaded guilty to a scheme involving the payment of over $600,000 in bribes to enable more than 3,000 claimants to receive disability benefit awards exceeding $550 million. Mr. Conn was sentenced to 15 years in prison; the judge was sentenced to four years and died while incarcerated. The investigation also led to a re-evaluation of over 1,500 disability awards, strengthened SSA quality reviews of disability appeal decisions, and renewed support for controls to detect and prevent fraud.

In addition to his personal work on oversight investigations, Senator Coburn helped enact legislation that increased the ability of Congress as a whole to conduct meaningful oversight. Besides his 2006 bill increasing federal spending transparency, in 2010, Senator Coburn won enactment of an amendment requiring the Government Accountability Office (GAO) to annually report on duplicate programs across federal agencies. GAO’s Comptroller General, Gene Dodaro, called this legislation “the gift that keeps on giving.” In the decade since the amendment passed, GAO estimates that the government has saved an estimated $429 billion by reducing “fragmentation, overlap, and duplication in federal programs” and by taking advantage of other opportunities identified by GAO “to save money and increase revenue.”[1]

In his farewell address in the Senate on December 11, 2014, Senator Coburn stressed the importance of congressional oversight to his colleagues:

“Each Member of the Senate has a unique role to participate and practice oversight, to hold the government accountable, and that is part of our duties, except most often that is the part of our duties that is most ignored. To know how to reach a destination, you must first know where you are, and without oversight – effective, vigorous oversight – you will never solve anything.”

Following his retirement, Senator Coburn continued his commitment to congressional oversight by serving on the board of the Levin Center for Oversight and Democracy and working with Senator Levin to inspire new members of Congress to engage in fact-based, bipartisan, in-depth oversight.

[1] U.S. Government Accountability Office. (2021, September 28). Duplication & cost savings. https://www.gao.gov/duplication-cost-savings

Learn More

To view some of Senator Coburn’s oversight reports:

- A Review of the Department of Homeland Security’s Missions and Performance (2014);

- Friendly Fire: Death, Delay & Dismay at the VA (2014);

- Parked! How Congress’ Misplaced Priorities are Trashing Our National Treasures (2013);

- Safety At Any Price: Assessing the Impact of Homeland Security Spending in U.S. Cities (2012);

- Department of Everything: Department of Defense Spending That Has Little to Do with National Security (2012);

- Federal Programs to Die For: American Tax Dollars Sent Six Feet Under (2010);

- CDC Off Center (2007).

Senator Coburn was also creative in using humorous videos and report covers to draw attention to his findings. One example: